The property market in Spain |

Looking at the property market in Spain, no matter where are you searching in order to buy a property, the first and main piece of advice is that you are not in a hurry. Take your time to know the different areas, the things that make one zone special. If you buy in an area of Spain, you are going to use much of your time there, so it is important knowing it well enough to think that you and your family will enjoy staying there every time you go and if it's going to be possible letting the property often enough to obtain some return.

Spain is a big country with different landscapes, cultures, customs... There are many options within Spain. The property market has different behaviors, prices, taxes and expectations, depending on each site.

Before taking the decision, is a must to analyze Spain and its property market. There are many variables that can influence your decision and that will affect the success of your investment both financially and personally.

It is very well known the economic situation in Spain. The financial crisis has been especially hard there causing a sharp unemployment increase and a general colapse in the property market in Spain.

The truth is that by 2007 the rising of property prices in Spain was exponential, causing that the property market values multiplied rapidly. This led to the construction of a huge number of houses to satisfy demand. The property bubble was growing. Investing in housing in Spain, no matter where, why or how, was a sure business. What was bought in one hundred, two years later was sold for one hundred and fifty. Everyone wanted to participate in this orgy of profits, including the different public administrations in Spain that received the taxes every time a property was built and conveyed.

But suddenly the credit sources in Spain stopped and the property market crashed. The big party was over and the view after the battle has been bleak in recent years: Developers unable to sell their new build properties, evictions due to default on payment of mortgages, banks repossessed the properties that had helped create.

Lately, since the beginning 2014, the macroeconomic indicators have begun to show a slow recovery of the Spanish economy. Unemployment figures, although still disastrous, have slowed their rising and forecasts are moderate job growth in the coming years. The harsh economic measures imposed by the government, despite being unpopular, are generating a return to the path of growth. In the last 2014 quarter the Spanish GIP grew 1,3%, being a data above the most optimistic forecasts.

The property market in Spain now continues seeing a very crippled domestic demand, but it's beginning to emerge the foreign demand of houses. In recent months, international investment funds such as Goldman Sachs, Värde Kennedy Wilson & Partners, Cerberus, TPG and Apollo, among others, have strongly entered the property market in Spain by acquiring important property portfolios.

Small overseas investors are also starting to take market positions in Spain and figures in 2013 and 2014 have shown the growing interest. In that period around 13% of housing transactions have been made in Spain by foreign citizens, compared to 8% in 2012 and 4% in 2009. The buying trend in the property market focuses on coastal tourist areas and in the main capitals.

The new rules about the inheritance tax in Spain and the possibility of deductions in the Spanish income tax for EU citizens, are helping to increase the confidence in the property market in Spain.

Trading volume is still low compared with the times of the great party, but it is starting to see a turnaround with prices stabilizing and even rising in the most attractive areas of Spain.

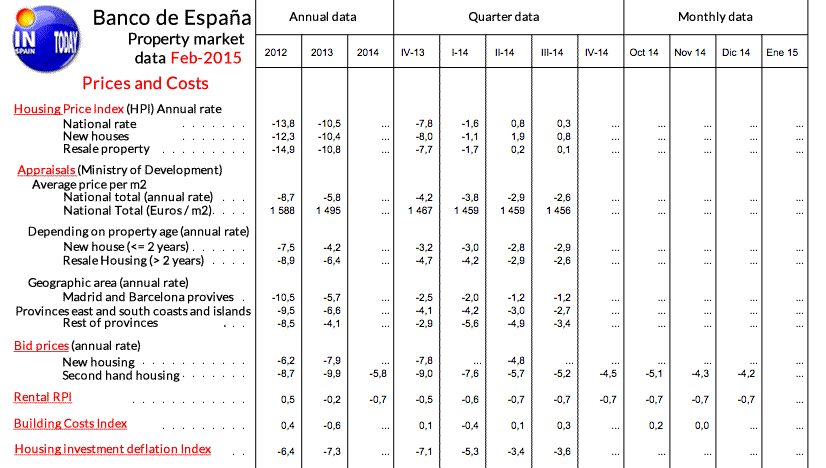

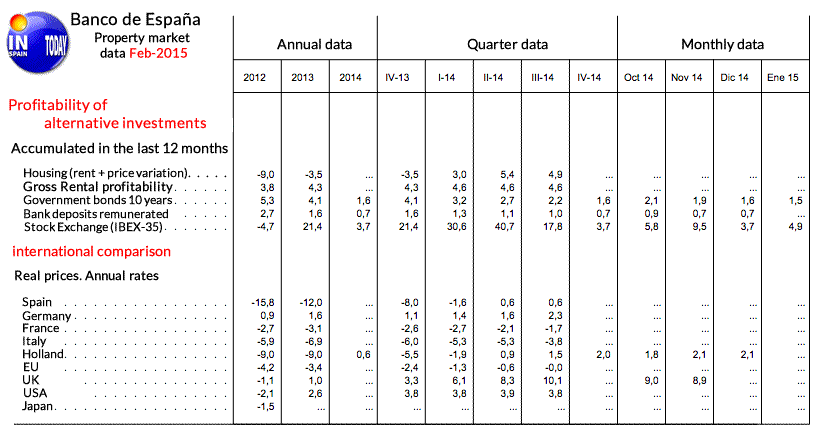

According to the latest report of indicators of property market published by the Bank of Spain on February 5, 2015, the data show a progressive stabilization of different variables on the property market in Spain, starting to see growing ciphers. The most interesting is the house price index (HPI) that shows positive figures in the second and third quarter of 2014, after several years with negative trend.

On the other hand the values of property in Spain, according to the last Appraisals data issued by the Spanish Ministry of Development, shows that the prices still going down, In a slower pace though.

When we look at the data published by the Bank of Spain in terms of profitability, we see the turnaround in the property market in Spain. The return of property in Spain has positive figures since the beginning of 2014, being even more profitable than public debt and bank deposits at the end of the period. This profitability of property in Spain is only surpassed by the stock exchange.

Comparing the profitability of the property market in Spain with the property markets of the major economies in the world, we see that the initial fall in values is changing towards a trend of stabilization and growth.

RELATED INFO |

Services by

|

Search property in Spain |

Do not pay for our servicesBuying a property in Spain with us our fees as lawyers, economists, appraisers and real estate agents are free. |

We take care of everythingLegal advice. Due diligence. Tax advice & returns. Appraisal. Contracts & Deeds. Property Registration... |