The property values according with the property market in Spain

Reading a post at the Luis Deluca Blog is possible to see how easy is to know the value of a property in Spain in a particular moment. This simple method is useful for knowing if is worth the rental or selling price of a property.

The way is calculate what should be the price of a property, and refine this value depending on the circumstances of the property itself.

How calculate the value of the property in Spain

There are two ratios used in the property valuation, the Gross Profitability for rent (GPR) and the Price Earnings Ratio. The first, the GPR, is the percentage calculated by dividing the yearly incomes from a rented property by its actual market value. Thus, A property rented with a Gross income 6.000.-€ (500 euros / month), and the property value is 120,000.-€, has a Gross Profitability comming from rent of 5%

6.000.-€ (Gross Rent Income)/120.000.-€ (Property Value)=5% Gross Profitability for rent (GPR)

The Price earnings Ratio

Calculating the opposite, what means dividing the property market value by the rental price, is obtained the Price Earnings Ratio (PER). This cipher express the number of years that will be necessary to have rented the property at a certain price to amortize the purchase price.

Price Earnings Ratio (PER) of the above property is 20 years.

120,000.-€(Property Value) / 6,000.-€(Gross Rent Income) = 20 years.

The data of the Gross Profitability for rent (GPR) is issued every quarter by the Bank of Spain, being for the period of the third quarter of 2014, 4.6%. What means that the Price Earnings Ratio for that period is 22 years or 264 months.

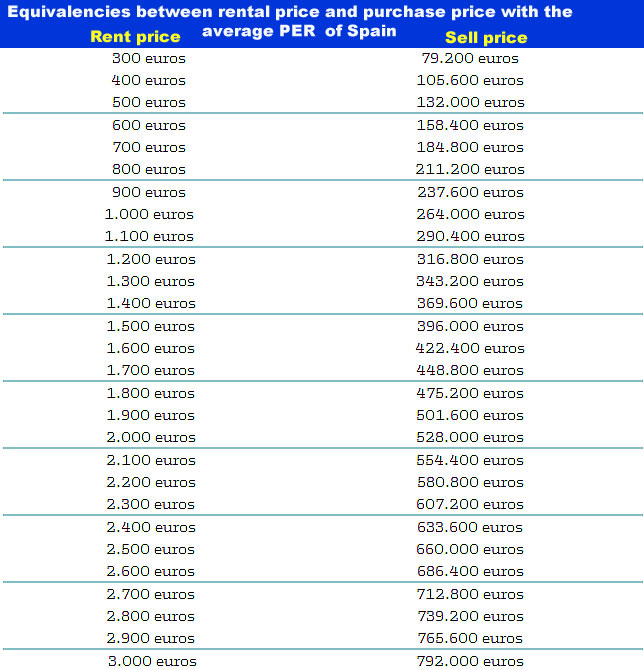

The next table shows the the relationship between the monthly rent by which is rented a property, and the hypothetical market value in accordance with the Price Earnings Ratio issued by the Bank of Spain for the last quarter of 2014.

4.6% Q3 2014 (PER 22 times). To calculate the different rental or purchase prices, multiply or divide one of

the data by 264 months.

For example, knowing the lease price of a property, multiplying that rent by 264 months (period needed to amortize the property according to the PER Q3-2014), we obtain the value that the property should have to meet to the Spanish average. Thus, if is leased in a monthly price of 1,000 euros, multiplying by the 264 months, the purchase price should be 264,000.-€.

The data contained on the table are useful when we have the option of buying or renting the same property. For instance, the same property has a price for sale of 200,000 euros and for rent has the monthly price of 500 euros (6,000 euros / year). Calculating the Price Earnings Rate of the property(200,000.-€ / 6,000.-€) the result is 33 times, cipher that is far away of the Spanish average of 22 times for the said period.

The conclusions looking at the table are that the lower the Price Earnings Ratio of property relative to the Spanish average (22 times), the better buying it, while the higher, is better to rent the property instead of buying it.

Correction of values depending on the circumstances of each property

The figure of the Price Earnings Ratio published by the Bank of Spain represents an arithmetic average of the values of selling and rental prices of property in Spain, but then must be corrected by the following variables:

-Where the property is located. Nowadays we are assisting to a turn up in the property prices in Spain, but not everywhere. The big cities and the coastal areas are seeing how their prices have started to rise, while the rest, generally, is still decreasing. However, the location must be analyzed at the point of researching the concrete area of the city where the property is placed. The property prices may vary enormously from a place to another inside the same city.

-The property quality. As is the former point, Is a must to analyze the materials, facilities and the rest of factors that could make a difference with the other properties in the same area.

However, The appraisal by a professional is a must

These are just some tips for a preliminary selection of properties in Spain. Unless you are an expert in the local real estate market is strongly recommendable to have the property you like appraised by a professional. The value of the property in everywhere is conditioned for different factors such as the legal status, the quality of the neighborhood, the condition of the building. Is necessary to value whether a property needs a major reform, whether or not it has an elevator, if there schools, hospitals or pharmacies nearby. All of which offer a bonus to housing or remove it.

The expectations in that particular area are other important factor for the appraissal of a property. Are ther plans for new facilities around...

It is a must analyze all these important details around that property, and, in the case that exists suspects about any kind of technical defects, an architectonic examination will be recommended.

An important fact to bear in mind is the valuation of property for tax purposes. It may be the fact that the market value does not match the value that the Tax authorities give to the property. Therefore it is necessary to know the fiscal value in order to avoid tax penalties for incorrect tax declaration.

Social links

Google+ Facebook Linkedin Twitter Instagram