All about selling a property in Spain |

Selling property in Spain involves a number of obligations and costs that must be faced by the seller.

The general rule selling a property in Spain is that the purchase is made free of liens and encumbrances, being up to date with payments and taxes, and free of tenants and occupants. But it is possible an agreement against this rule.

The selling process

Selling in Spain: The property status

Selling property in Spain: The costs

Selling property in Spain: The charges' cancellation costs

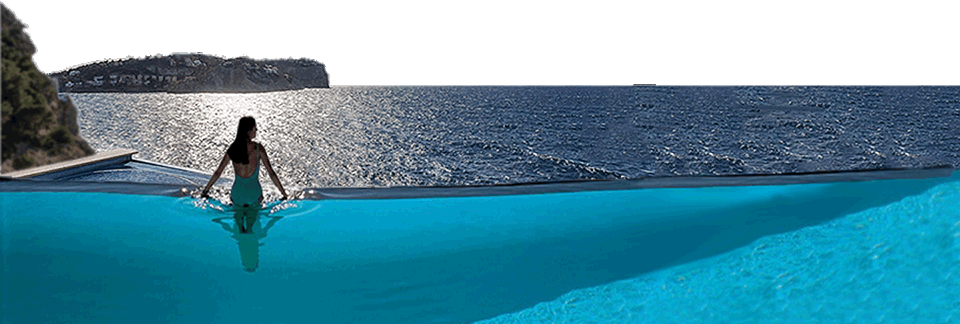

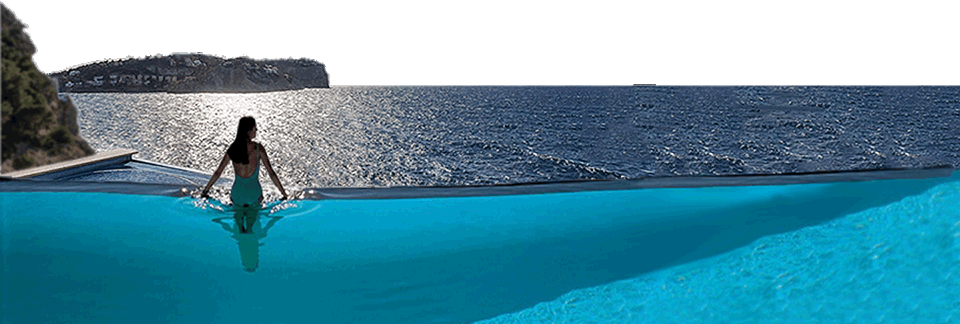

It is always a good idea to put the property up for sale in the best possible condition, trying to attract the buyers attention.

The good shape of the property must be from the point of view legal and physical. Is advisable to do in advance (if possible) the reparations needed by the property and the whole legal paperwork in the form of cancellations. Waiting until the purchase moment will bring that another one taking care of it on our behalf...Believe me, it will be way more expensive.

In case of defects is advisable to be remedied and, if not possible, to inform the buyer of its existence, because if he finds out after the purchase, has a period of six months to take legal actions.

These are the costs selling a property in Spain:

Depending the region where you are selling the property in Spain, the notary costs could be shared between the counterparts. To tell the truth is what the law dictates (the sharing), but in some places is accustomed that the notary cost is paid only by the buyer. In the case of following the law and not the custom, the notary fees will be paid in a proportion of 75% by the seller and 25% the buyer, approximately.

As a result of selling a property in Spain, you have to pay the tax on the increase in the value of urban land, also known in Spain as Plusvalia tax. This tax is applied only to property of urban nature and obligues to pay only for the value of the plot, not for the built value.

This is a local tax. It is paid to the city hall where we are selling property in Spain.

The taxable base of this tax selling property in Spain is based on the cadastral value of the property. This value is given to each property in Spain by the tax authorities, and is divided in Land value and Construction value. Well, we only take into account the given Land value to calculate this tax. The second factor that determines this tax is the period of time that the property has been owned by the seller.

Based on these two factors, the municipality applies the tax rates, which are the same all over Spain when selling a property. What makes different the tax paid depending the place, is that each city hall has the possibility to apply more or less bonifications.

Normally, the higher cost selling property in Spain is this tax. It is subject to taxation obtaining a capital gain resulting from the sale of a property.

Since the beginning of 2015, there has been a reform in this tax in Spain changing the taxation of the property yields.

In general, the gain is determined by the difference between the values of transmission and acquisition.

The acquisition value is determined by the actual price of the property involved, plus all costs and taxes paid when bought, excluding interest. Depending on the year of property acquisition, this value is corrected by the application of an updating coefficient, which is established annually, in accordance with the Spanish General State Budget Act.

The transmission value is the actual amount for which the property selling is made, reduced by the costs and taxes paid by the seller, related to the transfer.

Well, the difference between the transfer value and the acquisition value, calculated in accordance with the above, will be the gain subject to tax.

Since January 1, 2015, selling property in Spain, the exemption for reinvestment in the principal residence applies to the taxpayers from the EU, Iceland and Norway.

| Year selling the property | 2011 |

2012-2014 |

2015 |

2016 |

|---|---|---|---|---|

| Tax Rate | 19% |

21% |

20% |

19% |

The person who acquires the property, whether or not resident in Spain, is obliged to retain and pay to the Treasury 3% of the agreed price, having this amount, to the seller, the consideration as payment on account of the capital gains tax based on income derived this transmission.

These are general lines. It is advisable to study the case as there are several peculiarities in the law.

In the case of existing charges or debts on the property, obviously they must be paid before the purchase, unless otherwise agreed with the buyer.

In the case of a mortgage, probably will be cancellatión fee on the pending amount owed to the bank. This is a huge cost selling a property in Spain. Therefore, always is a good idea try to negotiate with the buyer his subrogatión on the existing mortgage. Fact that would save big money to both parts.

If the charges and encumbrances are inscribed in the Land Registry, as is the case of a mortgages in Spain, the cancelation of this charge will make necessary the signing of a cancellation deed before a notary, the Stamp duty, and the cost of the Land Registry.

These are guidelines for the cancellation of the most likely charge found when selling a property in Spain, which is a mortgage. In the case of different burdens like embargos and resolutory conditions, the cancellation process may vary.

At the moment of signing the mortgage deeds was agreed the cancellation fee. Use to be between 0% and 0.5% on the pending mortgage capital. This is a big cost selling a property in Spain.

Once the mortgage capital and the cancellation fee is paid, is necessary to obtain from the bank a mortgage cancellation certificate, in order to proceed to the cancellation of the charge in the Land Registry. The Bank of Spain says that the certificate must be free of cost. However, be carefull, the bank is looking forward giving you a "goodbye kiss".

To cancel a previous charge, inscribed in the Land Registry, for selling a property in Spain, is necessary the signing of a cancellation deed before a notary. For that purpose it is necessary to present the certificate given by the mortgage bank declaring that the debt is zero. The cost of this deed is a fee around 90€ and does not depends on the charge value.

With the new mortgage regulation in Spain, cancelling a mortgage is exempt from payment the Stampt duty, however still is necessary filling the tax (zero tax). This works in such way in the case of the mortgage, if the burden is of a different nature probably it is still obliged by the stamp duty.

The documents required by the Land Registry for the charge cancellation are: the certificate given by the bank, the tax form filled and the cancelatión deed. The cost will be between 24€ and 84€ depending on the value of the mortgage canceled.

Probably the buyer will need a mortgage to buy the property in Spain, what will imply that his bank requires all paperwork made by someone they trust. Therefore, the cost of the Administrative manager company is imposed by the buyer's bank, even if you are capable to do the paperwork by yourself. Administrative manager will take all the necessary steps to cancel the prior mortgage in the Land Registry. The manager fee is not regulated and may vary from company to company. The cipher will be around 250 €.

According to the particular circumstances of each purchase, could be generated another costs selling the property.

The general rule in Spain is that the real estate agent fee is paid by the seller. The figure use to be 5% of the property value, but only the official Spanish real estate agents (Agentes de la Propiedad inmobiliaria) have a fixed fee established by their professional body. Selling our property in Spain, always is advisable negotiate the fees with the agent, trying to obtain the best service and visibility for the money paid.

The complexity of the process selling a property in Spain make necessary to hire a lawyer specialized and experienced in property in Spain. The fees being a licensed lawyer practicing in Spain, are fixed by the professional Lawyer Bar. As a guide, and depending on the circumstances of each case, the cost will be around 1% -1.5%.

RELATED INFO |

Services by

|

Search property in Spain |

Do not pay for our servicesBuying a property in Spain with us our fees as lawyers, economists, appraisers and real estate agents are free. |

We take care of everythingLegal advice. Due diligence. Tax advice & returns. Appraisal. Contracts & Deeds. Property Registration... |