All about owning a property |

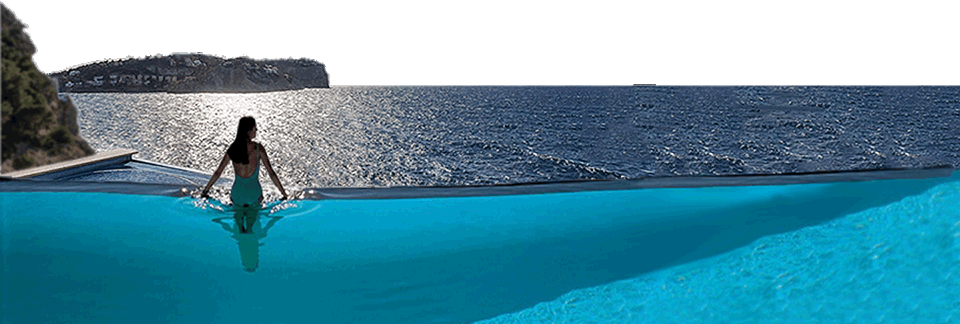

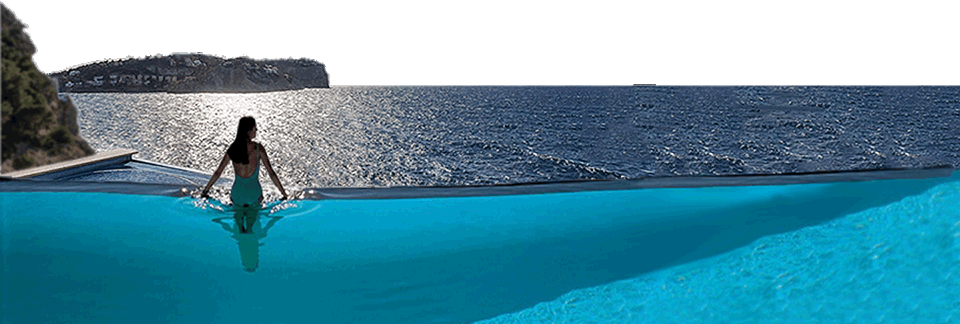

Owning a property in Spain is often a great source of good times. Having the opportunity to enjoy your own space in a place with good weather, good atmosphere, awesome food and competitive prices...is a luxury available to a very few.

The problem is that owning a property in Spain entail expenses ...

In every municipality in Spain is levied yearly the local property tax, Impuesto de Bienes Inmuebles (IBI Tax in Spain). This tax is applied on rural and urban properties. Therefore, owning a property in Spain, this tax always is going to be applied.

The tax is accrued on January 1 of each year, corresponding the tax liability to the owner of the property at that date. This point can lead to confusion at the moment of selling a property, due to its payment generally is asked later by the city hall. But, in Spain, the person obliged by this tax is the one who was owning the property the first day of the year.

The taxable base for the Ibi tax in Spain depends on the cadastral value of the property, on which the tax rate is applied. The tax rate is determined by the Spanish Local Finance Act (Ley de Haciendas Locales), fixing minimum and maximum rates for each estate based on the kind of property and the type of municipality in which is located,

| min. rate | max rate | |

|---|---|---|

| urban property | 0,4% | 1,1% |

| rural property | 0,3% | 0,9% |

Taxation depends on whether the property is leased or not:

In the event that the property you are owning in Spain is leased, the taxable base will be constituted by the yields obtained during the year, paying separately for each accrual (several properties=several calculations).

In general, the tax base will be the gross income. But in the case of the tax payer owning a property in Spain that is rented out, is resident in another country member of the European Union (plus Norway and Iceland); for the determination of taxable base, may deduct the costs directly related to the obtention of the yields. To the taxable base, obtained in a way or another, depending whether you are european or not, must apply the next tax rate:

| Year of accrual | 2007-2011 |

2012-2014 |

2015 |

2016 |

|---|---|---|---|---|

| Tax Rate | 24% |

24,75% |

|

|

If the property in Spain is not rented out (used by the owner or is unoccupied), To obtain the taxable base, will be estimated as income the amount resulting from applying to the cadastral value of the property, the following percentages:

It will be declared the proportional part of these figures in the event of the property was not owned during the whole year, or if it has been leased for a period of time shorter than the year (a period that will be taxed by the rules seen above for the leased property).

To these estimated incomes, owning a property in Spain not leased, have to apply the next tax rates:

| Year of accrual | 2007-2011 |

2012-2014 |

2015 |

2016 |

|---|---|---|---|---|

| Tax Rate | 24% |

24,75% |

|

|

Temporarily, for the years 2011, 2012, 2013, 2014 and 2015, has been restored this tax, which is accrued on December 31 of each of these years.

This tax levies the net wealth of the individuals. The net wealth is constituted by the set of goods and economic rights of one person, decreased by the value of charges and encumbrances, as well as personal debts and obligations of which the owner is liable. There is a minimum amount exempted up to 700,000 euros. If you own a property in Spain which its net value is below this figure you are not obliged by this tax.

Owning a property in Spain, the most likely is that it belongs to a community of owners, trying to organize and take care of the common elements of the building where the property stands.

The most conventional communities are those in apartment buildings where common structural elements are shared by all properties, as roofs, pipes or foundation. Those must be maintained by all apartments.

Communities may become larger and share gardens, sport courts, recreational areas ... Which leads to a greater community fee. It is not surprising either in some housing estates, still not sharing any constructive element or amusement area, that community fees are paid for the upkeeping of the paths or basic communal services of the urbanization. It is a good idea to check out the community of owners before purchasing any property in Spain.

A community of owners in Spain is a legal entity made up the total owners of one building (or urbanization), and is governed by the applicable laws and the rules for them agreed.

The community fee depends on the common services shared and the number of owners who integrate the community. Another important factor is if the community of owners is managed properly.

Anyway, owning a property in Spain integrated into a community of owners is a good way to enjoy amenities like garden or pool in a more economical way.

Maintenance, damages and repairs in Spain

In the event of needing any repair on your property, the offer of professionals in Spain is large and the prices generally are affordable. A good piece of advice is to ask for several detailed budgets and compare them.

Another common thing that will come across, it will be their offer to make the works "cheaper" and do not charge the VAT (IVA in Spain). The answer should be NO, due to three reasons:

First of all, it is a fraud and if you are caught in such fault the fine will be high;

Second, Not having an official invoice limits the possibilities of claiming in case of dissatisfaction.

And third, now with the new income tax regulation in case of the property in Spain is rented out, you have the right to deduct such amount, but only with the invoice.

When the works at home becomes bigger it is a must to apply for a work licence in the City Hall.

Another wise thing is to have a Home insurance covering any possible damage to our property and the ones caused by us to third parties.

RELATED INFO |

Services by

|

Search property in Spain |

Do not pay for our servicesBuying a property in Spain with us our fees as lawyers, economists, appraisers and real estate agents are free. |

We take care of everythingLegal advice. Due diligence. Tax advice & returns. Appraisal. Contracts & Deeds. Property Registration... |