Property Visa in Spain |

The Spanish Act 14/2013, 27 September, includes the possibility of granting visas and residence permits for foreigners that invest in Spain. The regulations stipulate that non-resident foreigners may obtain a residence visa by making a significant capital investment (2 million euros in Spanish debt titles. 1 million euros in stocks or shares of Spanish companies, or bank deposits in Spanish banks), Developing a bussines project considered as of general interest, or buying property in Spain from 500,000 euros. What is popularly known in Spain as the property visa.

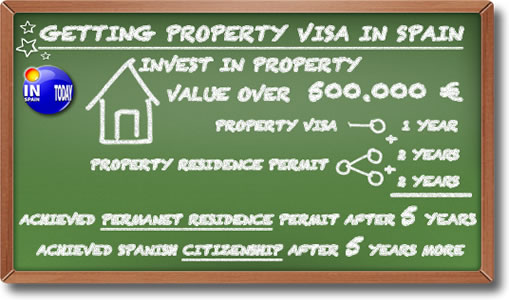

The scheme of the Visa due to investment property in Spain, that could ends even getting the Spanish citizenship, is as follows:

There are companies selling The property visa issue in Spain as if it was so difficult to get as finding the Holy Grail. Get the visa property is easy in Spain. You just need to meet the following legal requirements:

In addition to the key requirement of the investment in property in Spain, to apply for the visa property is necessary to completely meet a number of personal requirements. The lack of compliance with one of them, or its faulty fulfillment, will result in rejection of the application for the visa.

The spouse and children under 18 (or over 18 who are unable to provide for their own needs due to health issues), accompanying the applicant may apply for the visa. To do this, they must demonstrate the compliance with the same personal requirements asked for the applicant.

The Investment in property in Spain can be done, either personally or through a corporation domiciled in a country not considered like a tax haven under Spanish regulations. In such case, the foreign investor must have, directly or indirectly, the most of its voting rights and the power to appoint or remove a majority of its board members.

Once assured that you meet all the requirements, both personal and real, the administrative procedure is initiated by filling the form and paying the fee. The procedure is managed by the Spanish Ministry of Foreign Issues, and his fee for processing the visa is generally 60€ (Unless reciprocity principles between countries are applied).

The application is delivered to the Spanish embassy in your own country or directly in Spain, for which it is a good idea to do a power of attorney to handle the process. Since the Act does not compel the applicant to appear in the process, the property visa in Spain may be requested through an authorized representative.

The applications for the property visa will be resolved and notified within 10 working days (unless authorities need further explanations for the application content).

In case of being approved, the property visa will be issued with one year validity. Its granting will be enough title to reside in Spain, the owner and authorized family members, without obtaining the foreign identity card. However, due to the foreign investors will be documented in Spain during the first year only with the property visa, in all cases must hold of the Identity Number (NIE) as it will result essential for most financial, professional or social arrangements, which intends to develop in Spain.

The property visa entitles the applicant, and relatives who meet the requirements, to reside in Spain for the period of one year.

The holder of the property visa in Spain have the right to move freely within the Schengen territory (most EU countries plus Iceland, Liechtenstein, Norway and Switzerland) up to 90 days per every 180.

No need to stay a minimum period in Spain, being only required to be at least one day during the year, but just in case the investor want to apply for an extension of the period of residency. Being able to enter and leave the country as much as is wanted. If the period of stay exceeds 183 days wthin the year, then will become resident from the fiscal point of view, which means be tax liable in Spain by all income and property worldwide (Ask for further information about this matter, there are more rules that determine the tax residency).

Anyway, being a property visa holder, by the mere fact of owning a property in Spain, no matter if is tax resident or not, the obligation of paying property tax in Spain is generated.

Once reached the year of the property visa, the investor who wants to continue his residence in Spain must apply for the residence permit due to property investment. to do so, this is the way:

The requirements for obtaining a residence permit due to investment in property in Spain, in addition to fulfilling the personal obligations seen for the property visa in Spain are:

Fulfilling all the above requirements gets the residence permit for investors, which will be valid throughout the country and will last for the next two years.

The period for withdrawal shall be twenty days since the filing of the application. whether it is not resolved within that period, the authorization shall estimated due to administrative silence.

The rights and obligations with the residence permit for investors are pretty much the same than with the property visa granted for the first year.

Once this second term of two years is reached (after the first period of one year with the visa), those foreign investors who are interested in residing in Spain for a longer period, may request the renewal of the residence permit for investors for the same period of two years. Just meeting the same requirements and presenting the mentioned documents for the renewal.

People who want to obtain permanent residence in Spain must have resided legally in Spanish territory in the period of five years preceding the application. The residence has to be continuous. Which means that the stay must be more than 183 days a year in Spain, making us liable residents for the tax purposes. Reached that point, The right of residing is gained no matter the property owned in Spain. Therefore, the residents in Spain due to investment in property that have been continuos residents, being liable as residents for tax purposes in the last five years, may apply for the permanent residence, being released of the property owning obligation.

After reaching the permanent residence, from now on without needing the owning any property in Spain, whether it is continued under the same conditions of permanent residence for a period of five years more, it is possible to apply for Spanish citizenship, becoming a Spanish citizen, and therefore European for for all legal purposes.

For nationals of Latin American countries, Andorra, Philippines, Equatorial Guinea, Portugal or individuals of Sephardic origin, the 10 years period of permanent residence to obtain the Spanish citizenship is reduced to only 2 years.

RELATED INFO |

Services by

|

Search property in Spain |

Do not pay for our servicesBuying a property in Spain with us our fees as lawyers, economists, appraisers and real estate agents are free. |

We take care of everythingLegal advice. Due diligence. Tax advice & returns. Appraisal. Contracts & Deeds. Property Registration... |