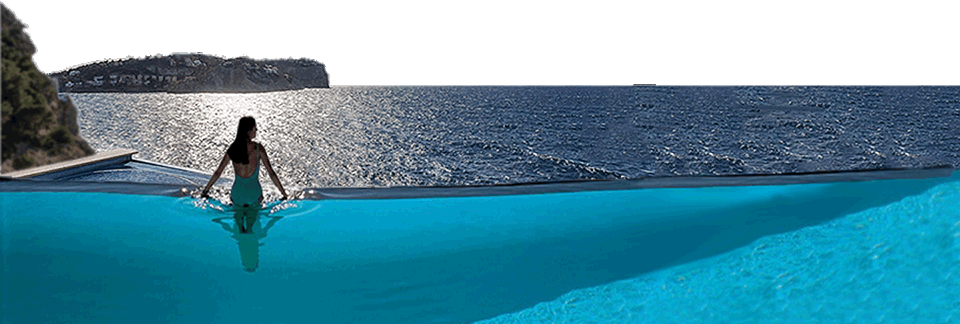

Bank Repossessions in Spain |

Nowadays the banks are the owners of a big part of the property for sale in Spain. These repossessed houses come from developers' bankruptcies and people that can not afford the payment of their mortgages.

The property repossessed is a product highly sought after by experienced investors in the property market in Spain. But anyone can buy a bank repossession in Spain.

If you are looking for a bargain is a good option to take a look to the repossessed properties owned by the bank. But be careful, all that glitters is not gold.

Here it is the list of the bank repossessions in Spain:

The foreclosure process in Spain, that ends with the house repossessed by the bank, begins when the mortgage debtor has fallen in arrears after several months without paying his monthly mortgage obligation.

The repossession by the bank follows a legal procedure that involves high costs for the debtor. Usually, once legal proceedings are begun, to the debt is added 30% more as late payment interest, legal costs and expenses.

In this period, before the procedure for repossession by the bank begins, is a good time to negotiate directly with the owner the purchase of the property, as he will be interested in selling the house and save as much as he can of his investment and credit.

Once the process of foreclosure is started, the usual path taken before the housing bubble burst in Spain, was the auction of property seized. In these auctions anyone can bid to acquire the property. The problem in recent times has been the lack of buyers in judicial auctions, which made the award prices were extremely low to meet the amounts owed by debtors on their mortgages. (Learn more about the mortgages in Spain)

This issue has led banks in Spain to begin with the repossession property by the way of the Assignment in payment. So, the bank before filing a foreclose suit, allows the defaulter to offer his/her properties to satisfy the total debt instead of starting the legal process.

Once the house is repossessed by the bank, it will try to sell it as soon as possible to avoid the costs linked to owning a property in Spain. The bank (generally) will consider any reasonable offer. Besides, buying a bank repossession in Spain is the best way to get a mortgage in the best terms. The banks are looking forward to get rid of these bargains and they are very open minded to listen your offer and give you the mortgage.

But, as said above, be careful. Commonly when you ask for a mortgage to the bank, this one becomes an ally to check that everything is in order around the property you're buying, but not in these cases. There are possible traps hidden like community of owners debts, local taxes unpaid, squatters in the property, ghost neighborhoods... It's a must checking the property.

RELATED INFO |

Services by

|

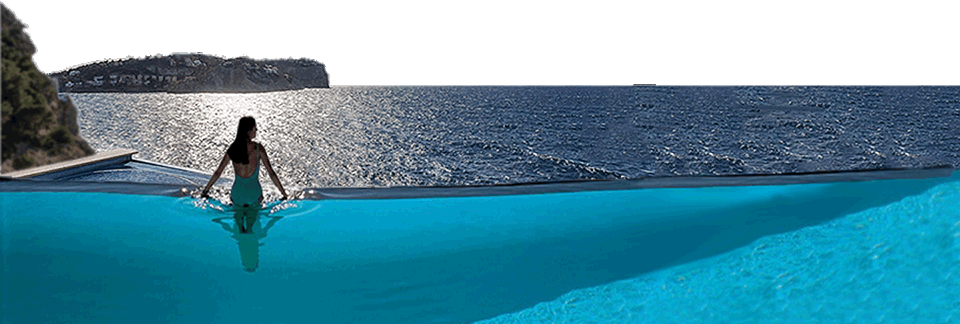

Search property in Spain |

Do not pay for our servicesBuying a property in Spain with us our fees as lawyers, economists, appraisers and real estate agents are free. |

We take care of everythingLegal advice. Due diligence. Tax advice & returns. Appraisal. Contracts & Deeds. Property Registration... |