Spanish Inheritance Tax

|

The Spanish inheritance tax is an imposition that is paid by the recipient of the inheritance in Spain. This tax is due in case the heir is resident in Spain or the asset being inherited is located in the Spanish territory.

The Act 26/2014, of November 27 has changed the rules on inheritance and gift tax in Spain applicable to non-residents who are citizens of an European Union country (EU) or European Economic Area (EEA). From now on, the Europeans citizens non-residents in Spain will be taxed by the Autonomous community tax rate of the place where the higher value property inherited is located, and not by the Spanish state regulation of the Inheritance tax, as has occurred until 2015.

This change is due to the recent ruling of European Court of Justice (September, 3, 2014 in Case C-127-12) that considers illegal the discrimination between residents and non-residents on the application of the Spanish inheritance tax. While the residents were paying the inheritance tax according with the autonomous legislation (with possibility of better deductions and tax reductions), the non-residents were governed by the state standard of the Inheritance tax, extremely unfavorable.

The amendment in the Spanish inheritance tax is based on establishing a special regime for non-residents in Spain, who are citizens of a country of the EU or the EEA, consisting of equalize their treatment with residents in Spain,

REAL LIABILITY

PERSONAL LIABILITY

Regarding to the Spanish inheritance tax, is considered that a resident in Spain resides in certain Autonomous Community, when lives in its territory the greater number of days in the period of the immediately preceding five years to the tax accrual (decease date).

The Inheritance tax is regulated by Act 29/1987, which applies generally in Spain, but each region (Autonomous Community) has the power to establish reductions in the tax base, the tax rates and deductions applicable. As we have seen the law has been amended by the recent Act 26/2014, of November 27, giving to non residents in Spain the same benefits that the residents have in the Spanish inheritance tax. In the Murcia Autonomous Community is regulated by the Murcia Law Decree 1/2010.

Every Autonomous Community has its own regulations about the Spanish inheritance tax. See some examples:

| Andalucia | Balearic Islans | Canary Islands | Murcia | Valencian Community | State Regulations |

The tax base of the inheritance tax in Murcia is the net value of the individual acquisition of each heir, being understood as the real value of the property and rights reduced by any charges and debts that may be deductible in accordance with the Murcia Autonomous community regulation.

Can be deducted generally the amounts owed by the deceased as long as their existence is proved. Also will be deductible of the Inheritance tax the amounts owed by the deceased to any of the public administrations in Spain.

In the calculation of the inheritance tax in Spain (Murcia), to the net value (value of properties and rights minus debts) of the goods inherited, depending on the family relationship with the deceased and the type of property inherited, will apply reductions on the tax base. These are the reductions according to the Andualucia regulations.

Relationship groups |

Reductions according to Murcia Autonomous community rules |

|---|---|

Group I: descendants and adopted under 21 years |

Reduction € 15,956.87 + 3.990'72 € / year less than 21. Límit: € 47,858.59 |

Group II: descendants and adopted 21 years and over. Ascendants. Spouses |

Reduction € 15,956.87 |

Group III: Family collaterals 2nd and 3rd degree. Ascendants and descendants in law |

Reductión € 7.993,46 |

Reduction for habitual residence |

95% limit of € 122,606.47 |

Disabilities |

|

Life insurance spouse, ascendants and descendants |

100% Limit € 9,195.49 |

Reduction due to inheritance Family business |

99%* |

Reduction due to inheritance money intended to form a business |

99%* |

Reduction due to inheritance Real Estate intended to form a business |

99%* |

Reduction due to inheritance of historical heritage |

95%* |

Reduction due to inheritance Farming business |

99%* |

*There are more specific rules. Consult us to know the exact figures of your Spanish inheritance tax

These reductions of the Spanish inheritance tax are according to the Murcia Autonomous community. This regulation applies to the taxpayers who inherit properties, representing the largest value of the estate, located in Murcia.

Not existing property to inherit in Spain, will apply the rules of the Autonomous community in which each heir resides. And, being the deceased resident in Spain, by the rules of the community where he resided.

See the Spanish inheritance tax Reductions in other Communities:

| Andalucia | Balearic Islans | Canary Islands | Murcia | Valencian Community | State Regulations |

To the amount obtenidad after applying tax reductions will apply the following deductions:

Relationship groups |

DEDUCTIONS according to Murcia Autonomous community rules |

|---|---|

Group I: descendants and adopted under 21 years |

DEDUCTION OF 99% of the Tax base after Tax Reductions |

Group II: descendants and adopted 21 years and over. Ascendants. Spouses |

DEDUCTION OF 50% of the Tax base after Tax Reductions |

Once already it's been implemented the appropriate reductions an deductions to the tax base of the inheritance tax, we have the net tax base, on which the tax rate will apply.

To the reduced net value is applied the following tax rates:

Tax rates according to Murcia rules |

|||

|---|---|---|---|

Net tax baseUp to € |

Gross Tax payable€ |

Rest net tax baseUp to € |

Applicable Rate% |

| 0,00 | 0,00 | 7.993,46 | 7,65 |

| 7.993,46 | 611,50 | 7.987,45 | 8,50 |

| 15.980,91 | 1.290,43 | 7.987,45 | 9,35 |

| 23.968,36 | 2.037,26 | 7.987,45 | 10,20 |

| 31.955,81 | 2.851,98 | 7.987,45 | 11,05 |

| 39.943,26 | 3.734,59 | 7.987,46 | 11,90 |

| 47.930,72 | 4.685,10 | 7.987,45 | 12,75 |

| 55.918,17 | 5.703,50 | 7.987,45 | 13,60 |

| 63.905,62 | 6.789,79 | 7.987,45 | 14,45 |

| 71.893,07 | 7.943,98 | 7.987,45 | 15,30 |

| 79.880,52 | 9.166,06 | 39.877,15 | 16,15 |

| 119.757,67 | 15.606,22 | 39.877,16 | 18,70 |

| 159.634,83 | 23.063,25 | 79.754,30 | 21,25 |

| 239.389,13 | 40.011,04 | 159.388,41 | 25,50 |

| 398.777,54 | 80.655,08 | 398.777,54 | 31,75 |

| 797.555,08 | 207.266,95 | Higher amounts | 36,50 |

These Rates of the Spanish inheritance tax are according to the Murcia Autonomous community. This regulation applies to the taxpayers who inherit properties, representing the largest value of the estate, located in Murcia.

Not existing property to inherit in Spain, will apply the rules of the Autonomous community in which each heir resides. And, being the deceased resident in Spain, by the rules of the community where he resided.

See the Spanish inheritance Tax Rates in other Communities:

| Andalucia | Balearic Islans | Canary Islands | Murcia | Valencian Community | State Regulations |

The tax payable inheriting in Spain (Murcia) is obtained by applying to the Gross payable tax, the multiplying coefficient depending on the pre-existing assets of the heir.

Multiplying Coefficients |

|||

|---|---|---|---|

Pre-existings assets€ |

Relationship Groups |

||

I y II |

III |

Rest |

|

From 0 up to 402.678,11 |

1,0000 |

1,5882 |

2,0000 |

Over 402.678,11 up to 2.007.380,43 |

1,0500 |

1,6676 |

2,1000 |

Over 2.007.380,43 up to 4.020.770,98 |

1,1000 |

1,7471 |

2,2000 |

Over de 4.020.770,98 |

1,2000 |

1,9059 |

2,4000 |

These multiplying coefficients used to calculate the Spanish inheritance tax are according to Murcia rules.

See the Spanish inheritance Tax Liability in other Communities:

| Andalucia | Balearic Islans | Canary Islands | Murcia | Valencian Community | State Regulations |

When the taxation is due to PERSONAL LIABILITY, the taxpayer is entitled to deduct the lower of the following two amounts:

RELATED INFO |

Services by

|

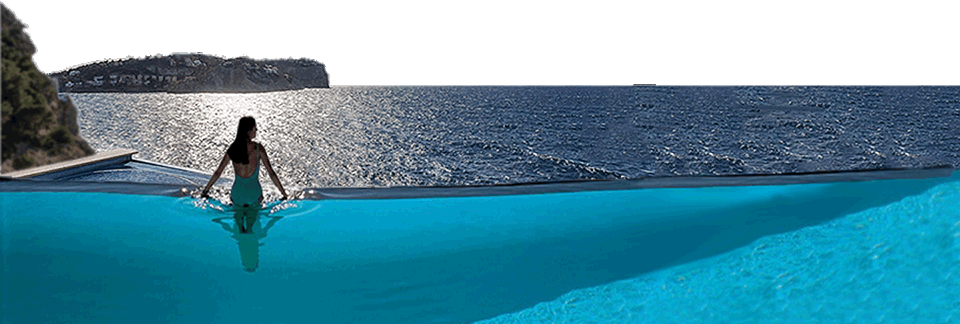

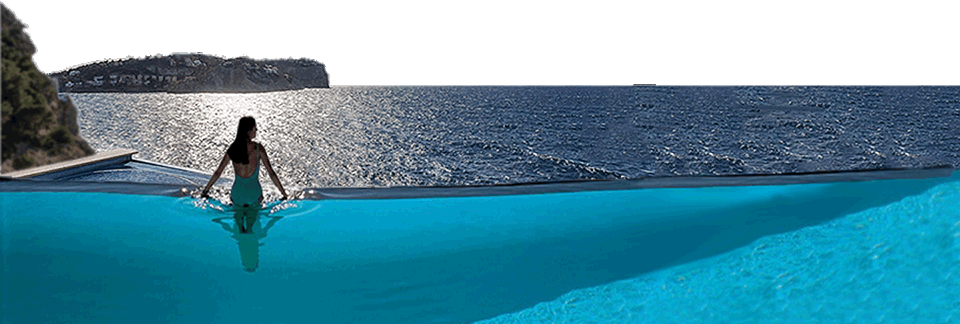

Search property in Spain |

Do not pay for our servicesBuying a property in Spain with us our fees as lawyers, economists, appraisers and real estate agents are free. |

We take care of everythingLegal advice. Due diligence. Tax advice & returns. Appraisal. Contracts & Deeds. Property Registration... |